A slow down or a speed hump?

Asian based purchasers have had a significant impact on the Australian property market over recent years.

This has been concentrated in the following sectors:

• Off the plan apartment purchases

• House/land in selected areas – Balwyn, Kew, Templestowe, Glen Waverley

• Residential development sites

• Investment properties

• Rural property

However over recent months (4th quarter 2015) evidence has emerged of a slowdown in these purchases.

The factors that appear to have influenced this include:

• The decline in the Chinese share market from June 2015

• The Chinese economic slowdown, particularly manufacturing

• Tightening Australian FIRB environment from early 2015

• 3% stamp duty surcharge on foreign purchasers introduced in May 2015

• Dramatic increase in FIRB application fees – up to $10,000 per $1 million purchase price introduced in May 2015

• Richard Wynn, Victorian Planning Minister’s, decision to implement reduced height limits in the Melbourne CBD, effectively reduced to a maximum of 24 levels, introduced in September 2015

• Increased enforcement of capital transfer controls for currency movements out of China (> View AFR article)

The consequence of this has been

• A reduction in Asian off the plan purchases, with apartment sales having dropped in the three months to end of November

• Dramatic reduction in enquiry on established residential in suburbs such as Balwyn, etc

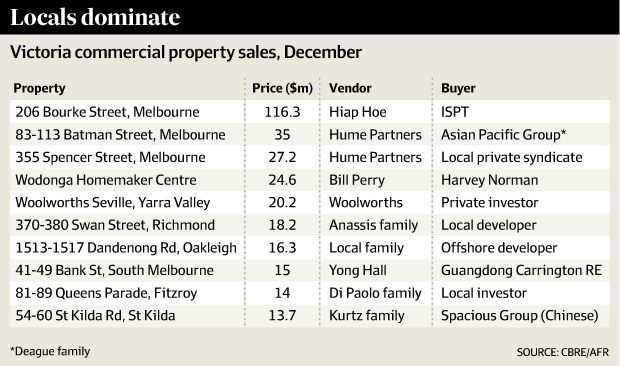

• A reduction in involvement by offshore purchasers in commercial deals in December

• Prominent Asian players reselling/walking away from sites

January 2016 – Major player Singapore’s Fragrance Group (Koh Wee Meng) who own 555 Collins Street and the Savoy Tavern site on Spencer Street and whose brother Koh Wee Seng (Aspiral) owns Australian 108 site is selling 555 Collins Street “as strict new planning constraints curb his aspirations to develop the site”.

Late 2015 – Developers AXF (Richard Gu) forfeits a deposit on 59-63 Bourke Street, stating “he could no longer make sensible profits from the site”.

The question is this a very short term issue, ie will bounce back over coming months, a temporary issue that may see things rebalance as volatility subsides in China over say 6 – 12 months or a longer term phenomena.

It is simply too early to tell, however is a factor of great significance to the Australian Real Estate market