Property Market Crystal Ball through the Lens of Victorian Stage 4 Restrictions

We thought it timely to provide our thoughts on the property market moving forward. This report does not purport to do any more than provide a view as to possible market dynamics post Stage 4 restrictions and beyond. There is insufficient tangible data at present to be definitive, thus the views outlined below are based on over 30 years experience of property market performance, particularly in difficult times, including the recessions of the 1990’s and post the Global Financial Crisis.

The Backdrop

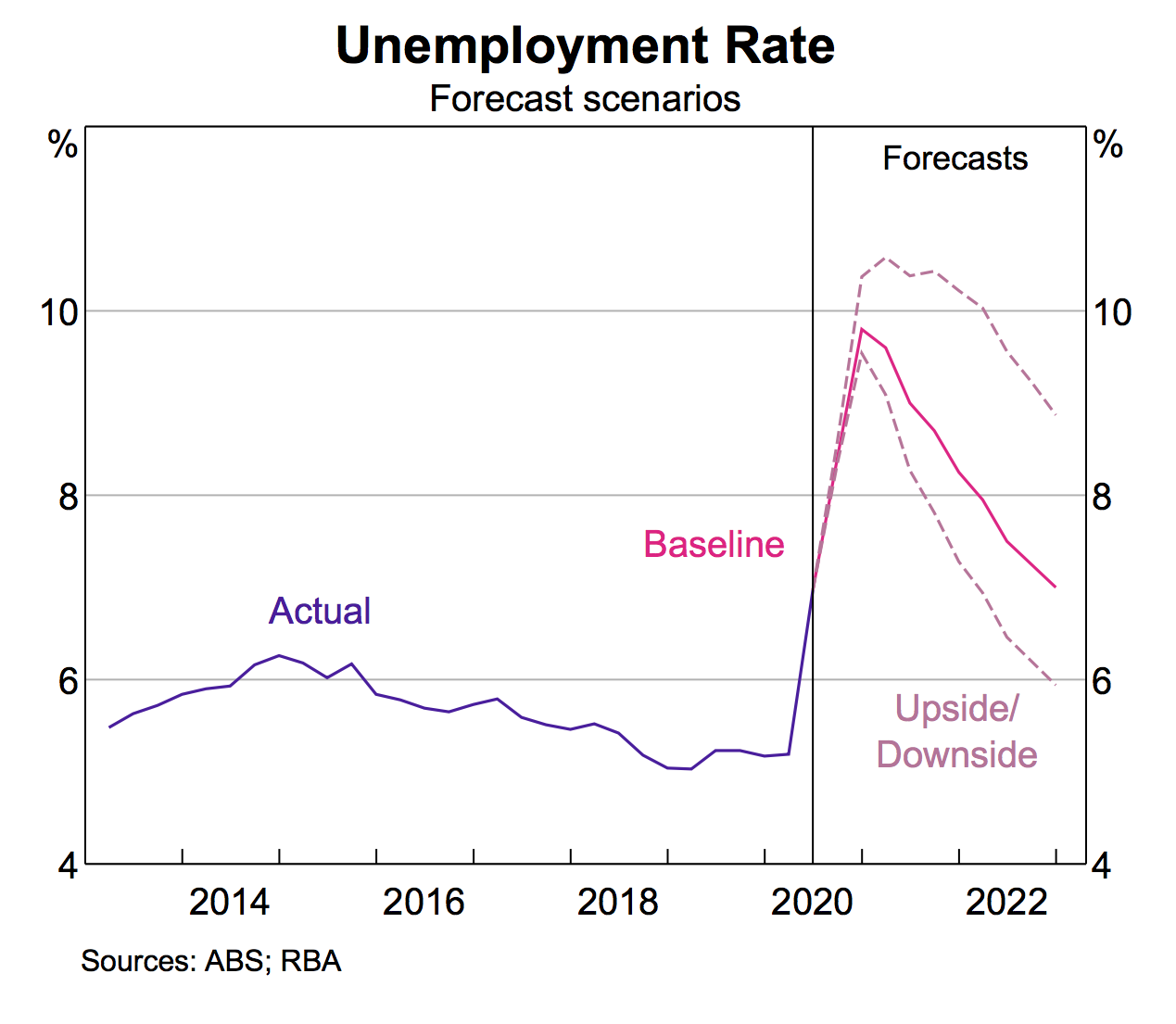

A key issue for all sectors of the property market will be the unemployment outlook moving forward impacting; residential demand and supply through forced sales; retail spending and its impact on logistics, manufacture and imports and office floorspace requirements (in addition to the significant COVID issues). The expected unemployment levels are as follows:

We obviously hope for the upside estimate, however the downside will obviously have longer lasting and more significant impacts. For comparative purposes Treasury advises Victoria’s effective unemployment rate fell from 14.6 per cent in April to 10.5 per cent in July, pre stage 4.

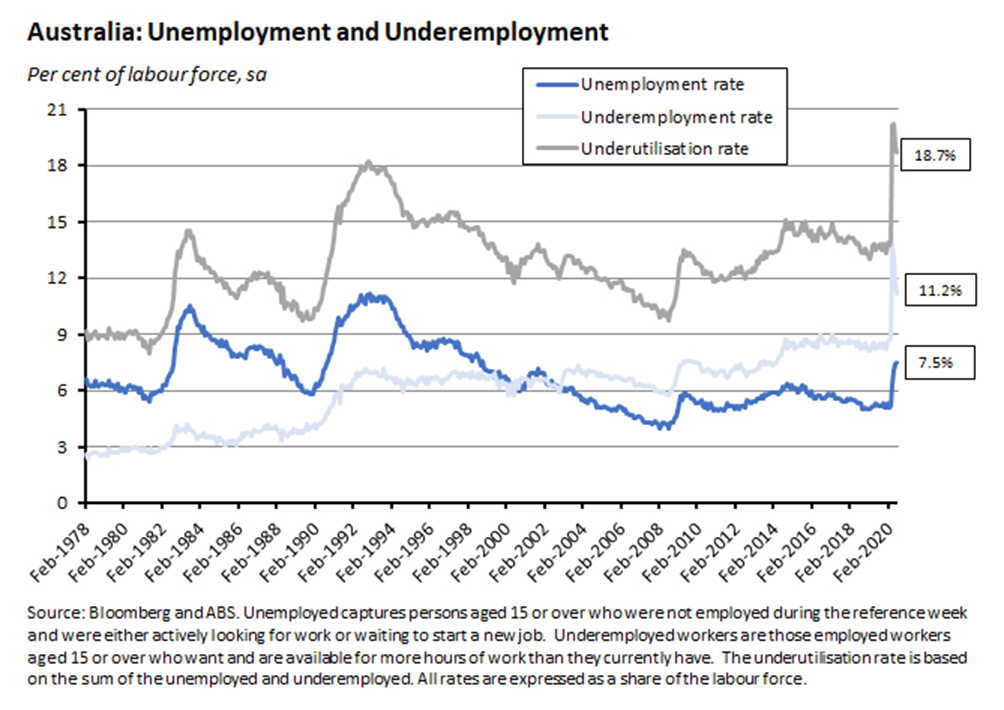

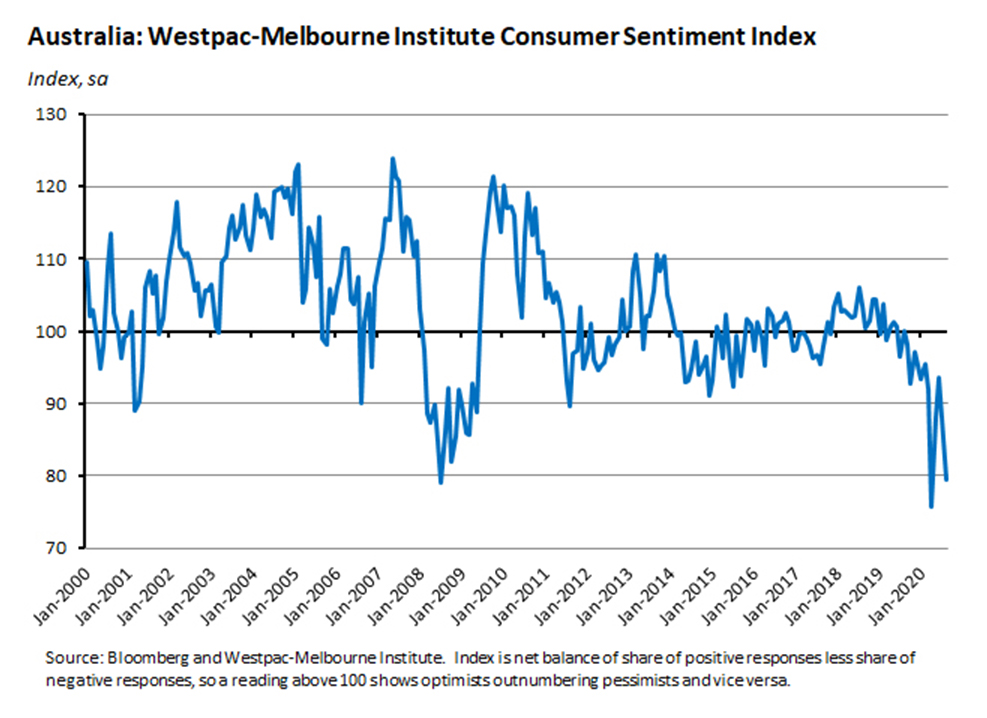

Of course unemployment is not the only issue, underemployment and underutilisation will impact consumer confidence and retail spending, which is illustrated as follows:

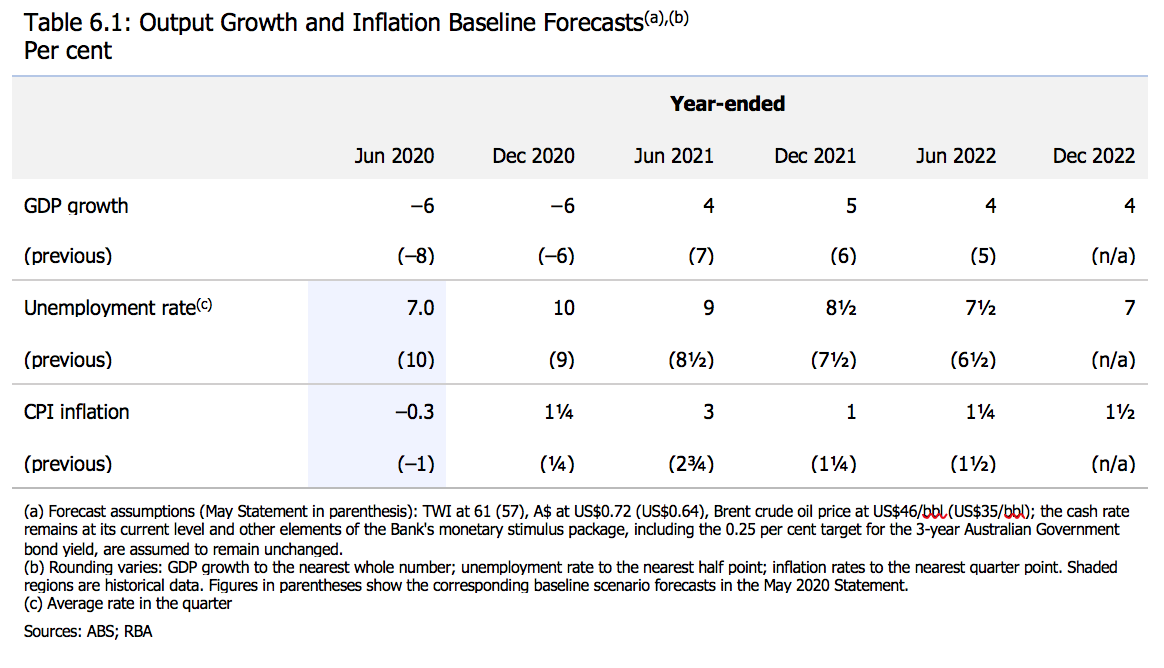

The RBA’s August update included revised economic estimates as follows:

We can only hope for the GDP bounce back predicted by the RBA, however you will note the more bullish bounce back predicted in their previous estimate and Victoria is subject to continuing Stage 4 restrictions, with ongoing high new case numbers and deaths.

We appear to have experienced a “dead cat” bounce in consumer sentiment prior to Victoria’s second wave outbreak and the implementation of Stage 4 restrictions.

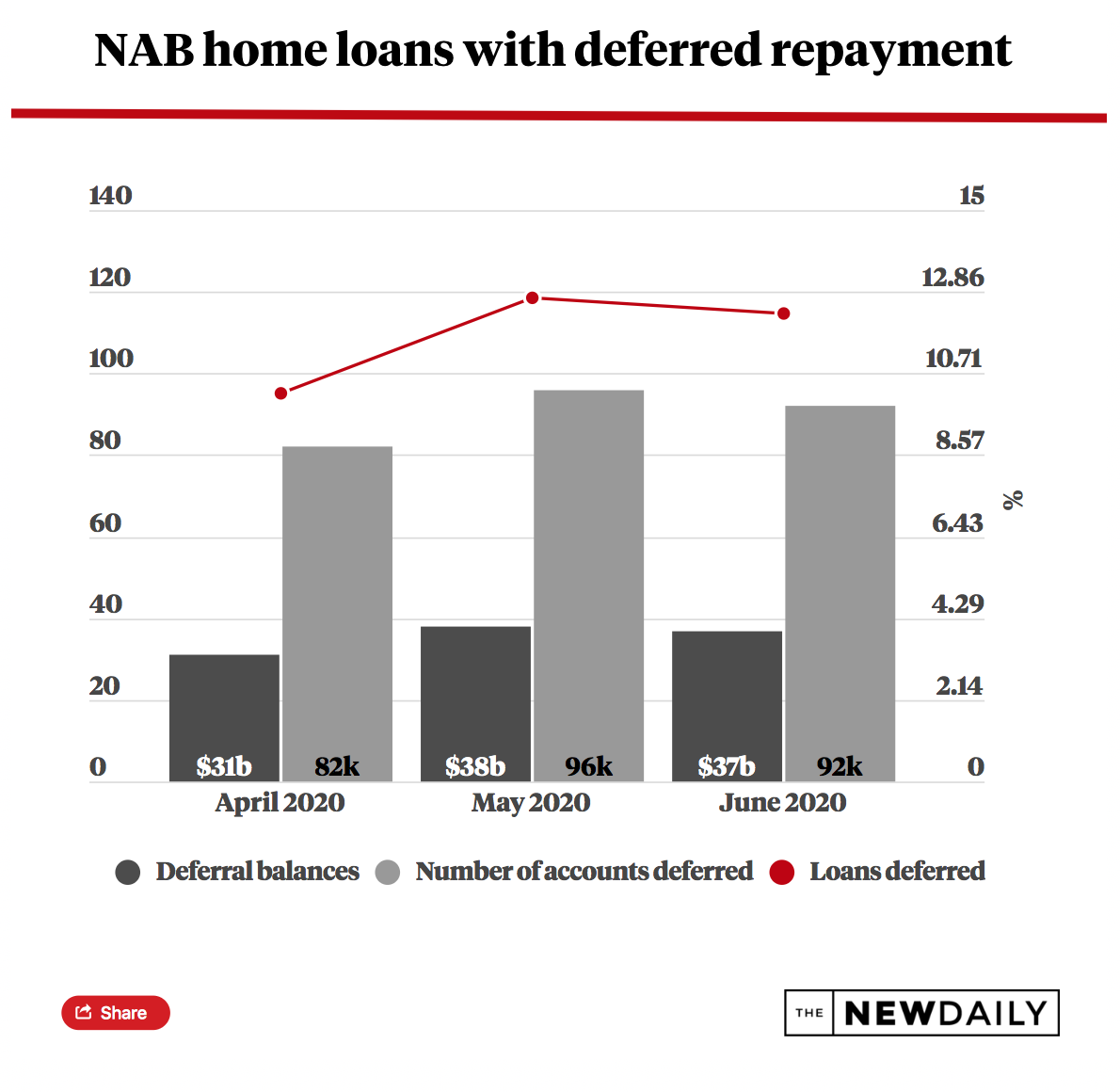

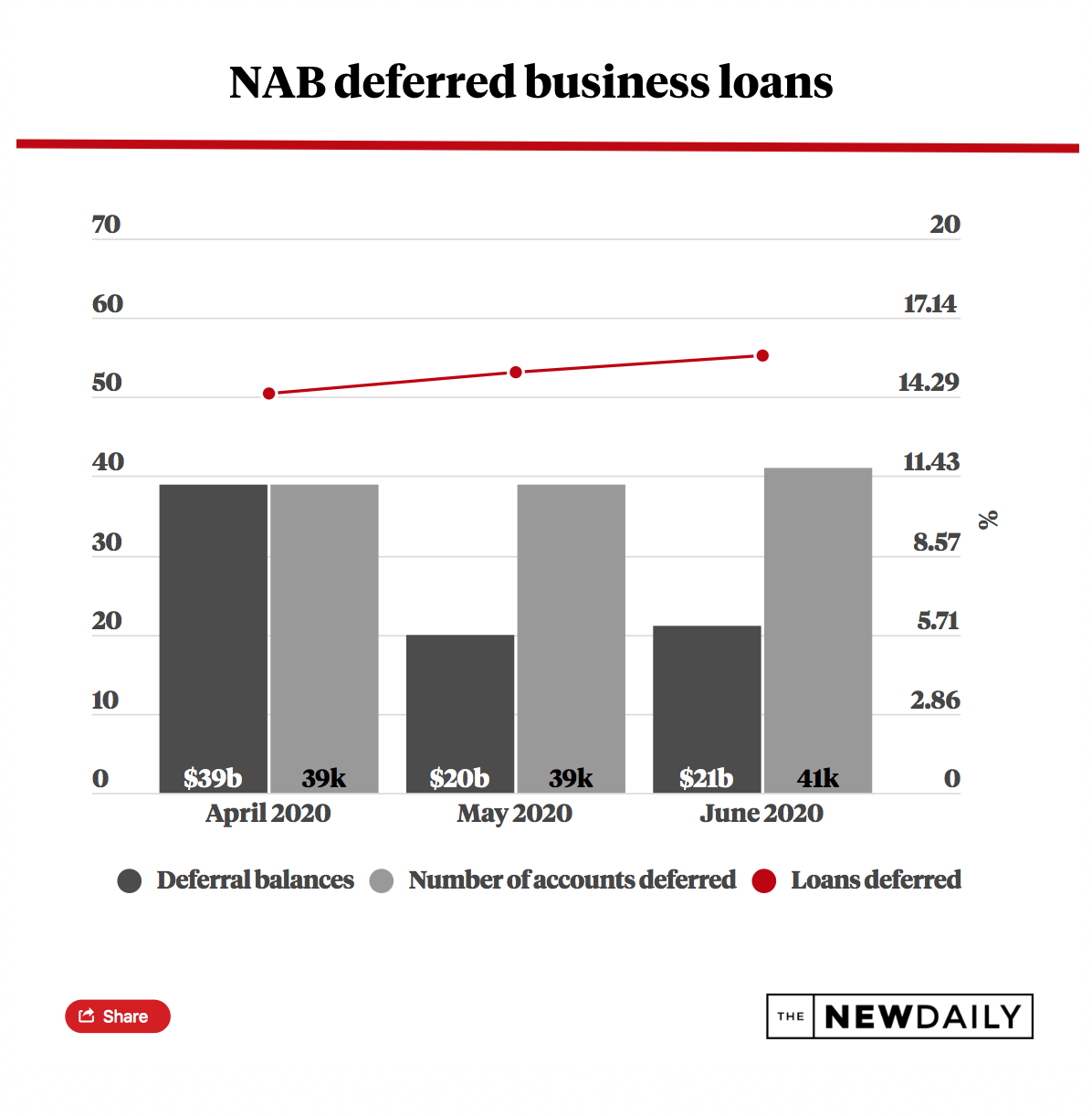

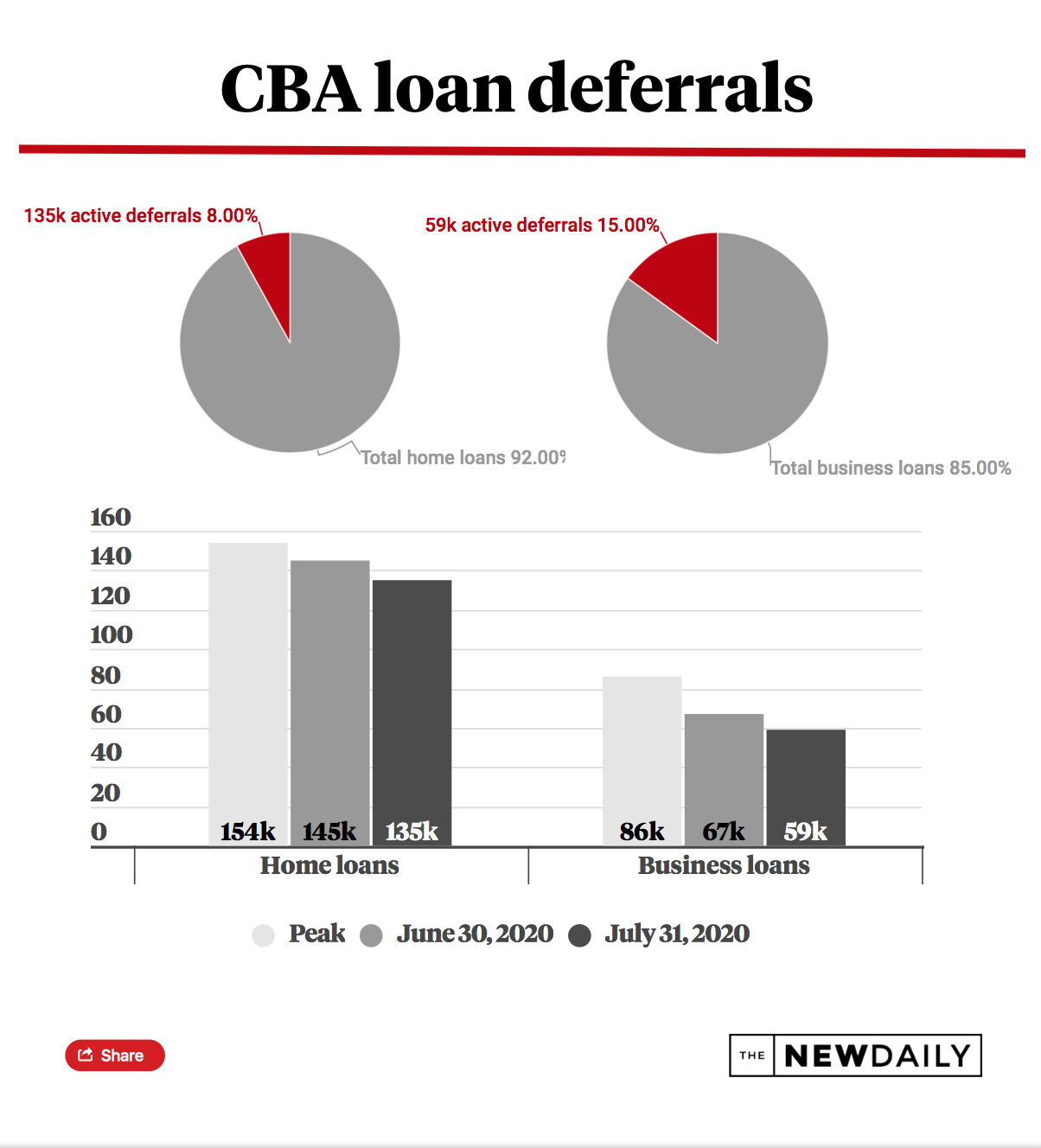

Ongoing loan deferrals are also a concern particularly the ability of borrowers to resume repayments.

The below graphs indicate that whilst there has been some reduction in deferrals, following the early strong initiatives, this has not been significant. We have detailed two of the major banks published deferral rates, being the NAB and CBA.

To give some overall perspective the Reserve Bank said at 31 July, 12% of mortgages across the banking system were in deferral, as were 20% of small business loans.

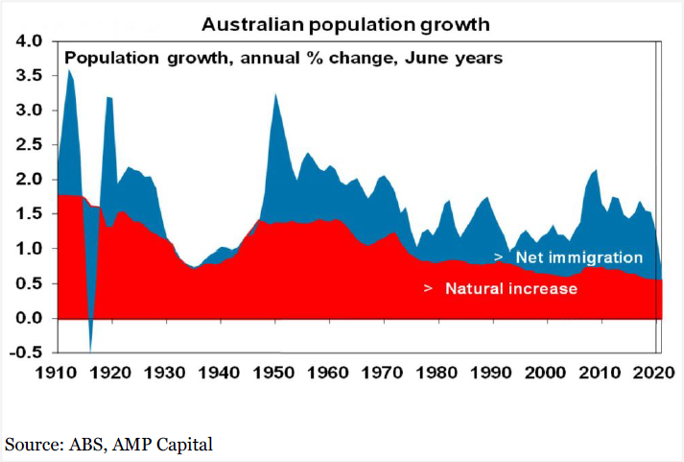

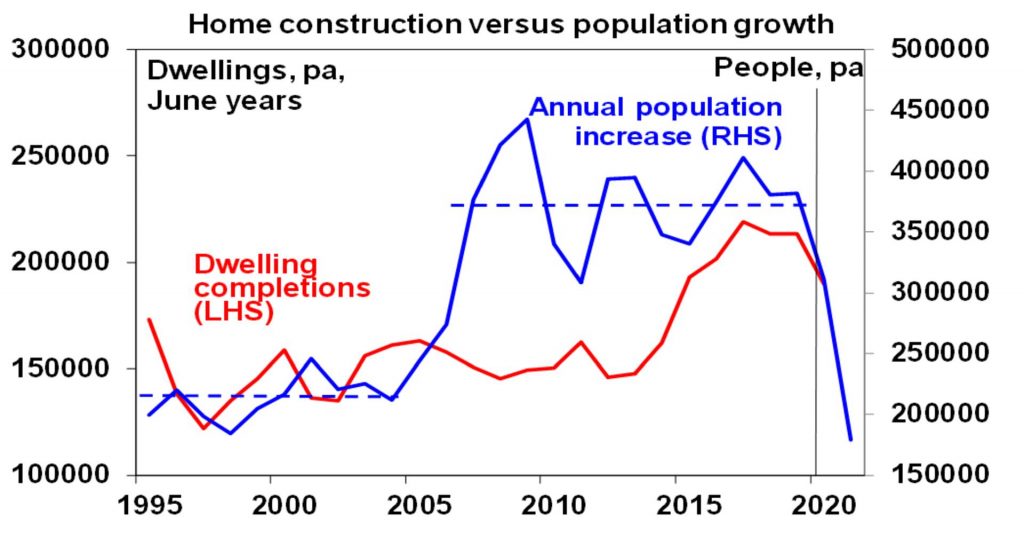

Net migration is critical as this has been a significant driver of our economy through retail and ultimately through demand and price growth in the residential real estate market. The population growth has plummeted in 2020 as illustrated in the annual % change in June years.

It is very difficult to see immigration numbers returning to pre-covid levels anytime soon, firstly due to ongoing border closures and then the inevitable political pressure created by high unemployment.

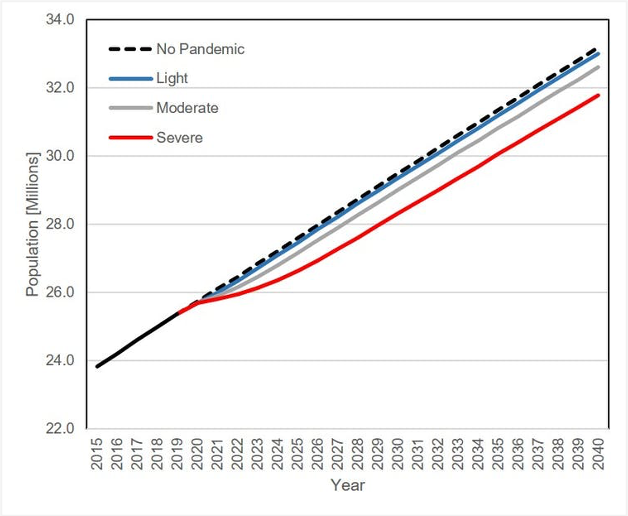

A recent paper published in The Conversation concluded that based on the modelled scenarios, COVID-19 is expected to have a measurable and persistent impact on Australia’s population.

Under the severe scenario, Australia’s population will reach 26.6 million by 2025, 29 million by 2030 and 31.8 million by 2040. This is 1.4 million or 4% fewer than the “no pandemic” scenario.

Under the light scenario, Australia’s population will be 180,000 people fewer by 2040. Under the moderate scenario, we will be down 580,000 people.

Source: The Conversation Media Group Ltd

The Conversation is an independent source of news and views, sourced from the academic and research community and delivered direct to the public. The team of professional editors work with university, CSIRO and research institute experts to unlock their knowledge for use by the wider public.

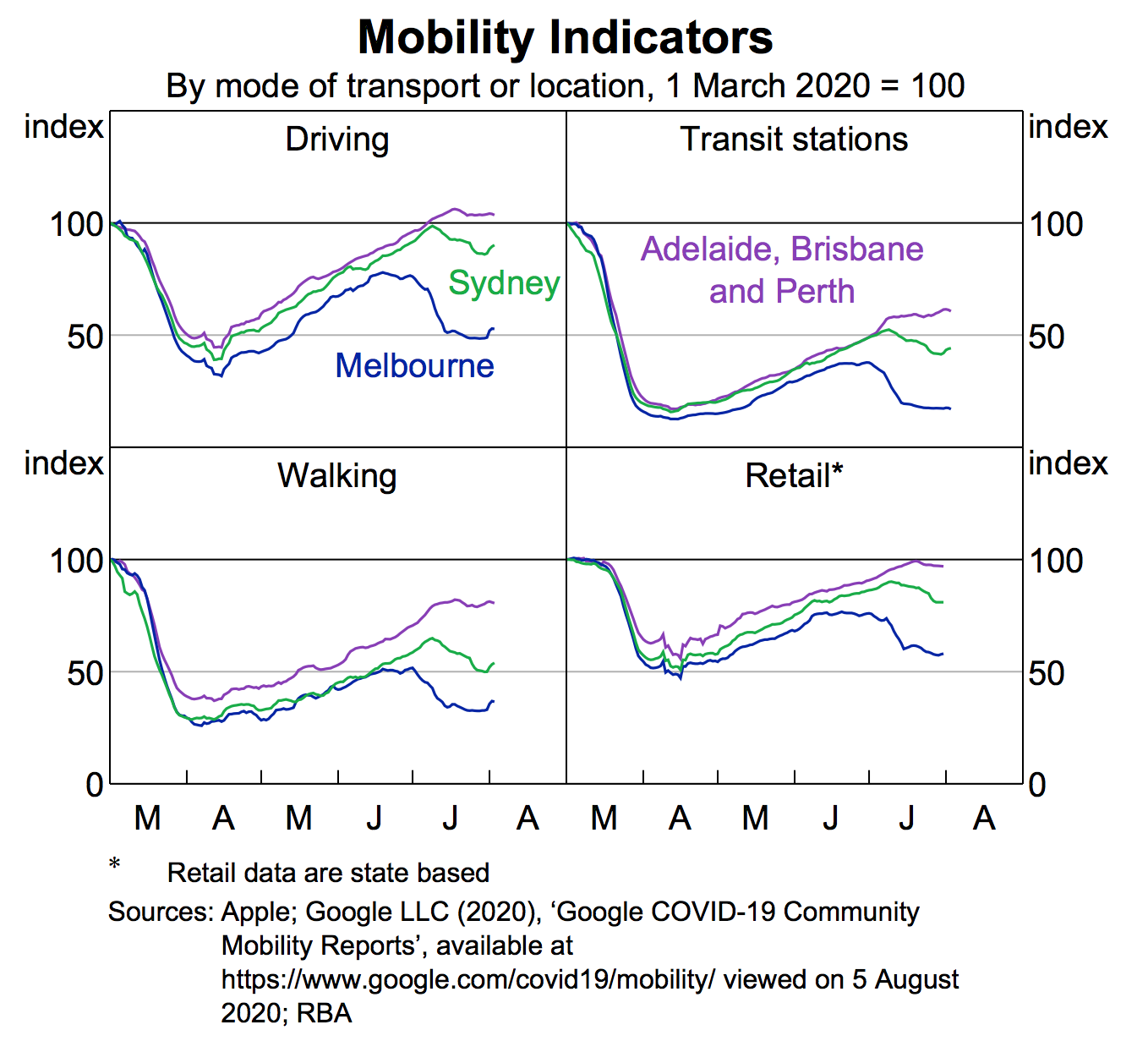

We can see in the following graph the impact of the early part of Stage 4 restrictions on Melbourne mobility in comparison to other states and this was before the majority of businesses were forced to shut down.

The Individual Markets

Residential

The impact on the Melbourne residential real estate market prior to Stage 4, was in general terms a reduction of 5-10%, however the market segments are more defined as follows:

- The lower end/First Home Buyer market had more limited impact and in some cases no impact;

- The $1 – $5 million was broadly down 5-10%; and

- $5 million plus was property dependent.

Moving Forward

The relevant factors in our view are as follows:

- Rising unemployment resulting in softer demand and potential increased supply through forced sales (both voluntary and lender driven).

- The above outlined decline in net migration leading to softer demand for both rental and purchase.

- Foreign student reductions impacting the rental market.

- Unemployment and the hardest hit sector, the young, returning to the family home, leading to lower rental demand.

- The above three factors putting pressure on geared investors creating forced sales.

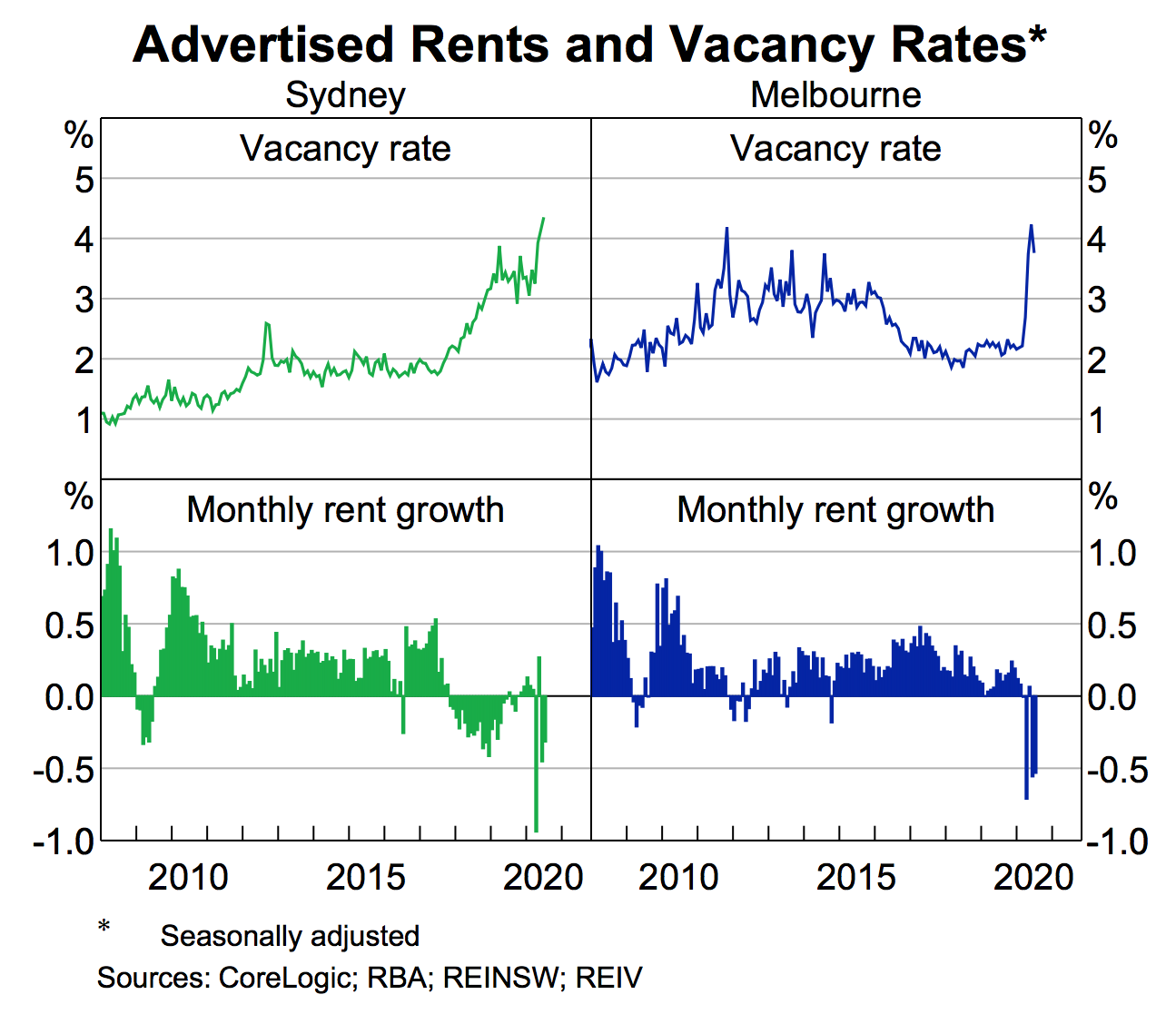

- We can already see upward pressure on vacancy rates and downward pressure on rents as illustrated in the following charts.

- CBD residential has been particularly hard hit in terms of rental levels and vacancy based on its strong reliance on foreign students, local students and the younger demographic. The strong predominance of geared investors in this market is a concern.

- The previous undersupply of dwellings which has for many years put upward pressure on prices is expected to reverse, with the potential for a significant over supply due to the above factors.

The above factors in our view may lead to a potential decline in the order of 10 – 20%.

A potential bright spot is lifestyle property due to:

- Ongoing working from home, with buyers focusing on quality of life, not travel times.

- The lack of overseas holidays, potentially for some time, driving people to consider a holiday home or upgrade their existing holiday home.

- A reluctance to continue to live in larger densely populated cities.

Industrial

The industrial sector is very much a two speed sector with:

- E-commerce/logistics/data storage – performing well.

- Older style stock with inferior transport linkages – underperforming.

The non logistics industrial sector will be affected by the macro economic issues, outlined above, including unemployment, GDP growth, consumer sentiment and net migration.

However overall, the industrial sector is experiencing the highest demand, as buyers move the allocation of their capital away from other sectors.

Whilst lease deals have ground to a halt due to current restrictions anecdotal evidence is that rents have broadly held up and yields are generally firm for better quality assets.

Office

Everybody is acutely aware of the potential impacts on the office market as we are all experiencing them, however we highlight the following.

Negatives

- Obviously ongoing working from home and the potential for a permanent shift in this regard.

- Many anticipate post COVID-19:

- 1/3 of employees will want to continue to work from home the majority of the time;

- 1/3 will split their time at home and in the office say 50/50; and

- 1/3 will wish to return to the office full time.

These obviously have significant impacts on ongoing demand.

Positives

- Greater workspace ratios will be required to accommodate social distancing with hotdesking a definite issue.

- Potential demand for small suburban offices from major corporations to spread their workforce.

There are reports of Melbourne CBD office portfolios with occupancy, excluding government tenants, well below 10% and this is pre Stage 4 restrictions coming into place.

There are reports that there has been an increase in some markets of sublease space hitting levels not seen since the 1990’s.

We must anticipate downward pressure on rents, increased vacancy rates and upward pressure on yields.

Retail

Again, to a degree two speed sector, with JB Hi-Fi and Kogan reporting strong profits and Ikea, Bunnings, the Supermarkets, etc and those with a strong e-commerce presence doing well.

Conversely discretionary/fashion/department stores are a very tough place to be. As are cafes and restaurants, with only takeaways allowed and ongoing social distancing issues.

Non-discretionary/convenience centres have performed much better with the reliance on anchor supermarket tenants and daily needs local specialties.

No one would be surprised to learn that Coles’ June quarter liquor sales were up 20.2% and supermarket sales were up 7.1%. Whilst JB Hi-Fi’s net profit was up 33.2% and Kogan up 55.9%.

In their results release Coles noted a change in the pattern of shopping, with customers migrating to neighbourhood stores at the expense of CBD, shopping centres or resort stores.

There are reports of Melbourne CBD retail portfolio visitation down to 20% and that was pre Stage 4 restrictions coming into place.

Moving forward we see an oversupply of retail resulting in:

- Downward rental pressure

- Increased vacancy

- Potential cap rate easing for other than prime retail or the outperforming sectors outlined above

One Bright Spot

Investment Property

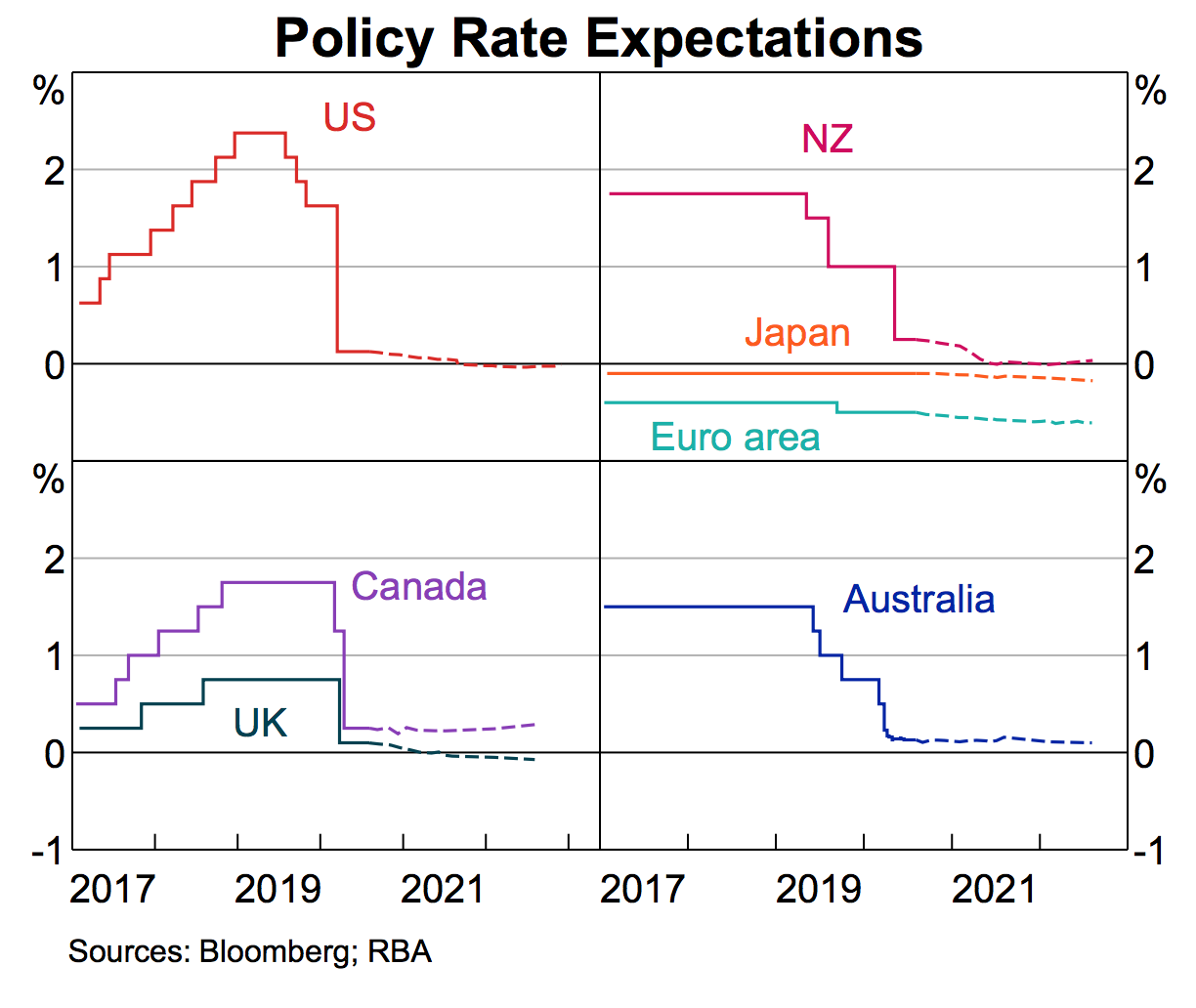

With interest rates likely to be lower for longer, investors are chasing return and therefore we believe yields will hold up, unless they are in a sector with obvious issues for tenants i.e. office/retail. International and Australian rate expectations are illustrated in the following chart:

Obviously the demand is dependent on the existence of a strong lease covenant, with a good quality tenant on a long term lease, not in an at risk sector.